Life Insurance

Life insurance is one of the most important components of your financial planning.

Apart from being a great way to ensure financial security of your family in case something untoward happens to you, investment in insurance provides a clutch of benefits, especially if you are young.

Purchase of the right insurance policy not only helps you hedge against the uncertainties of the future, but also offers many other advantages.

Besides, do not overlook benefits of a life insurance during your lifetime, especially if you are young.

You can now partner with anyEMI to buy the right plan for you, as one of the Directors on Board of anyEMI has become a Certified Insurance Advisor with the Life Insurance Corporation of India Ltd. This Navratna Company in Public Sector is the oldest insurance firm and also the largest financial institution of the country - with a massive investment corpus of ?31 lakh crore.

If you are still not ready to purchase an insurance policy, here is a list of 10 compelling reasons for buying a life insurance policy from anyEMI who partnered with LIC.

1. What happens to your loved ones when you are no longer there? This is the nagging worry of any individual who loves his/her family. Investment in a good life insurance plan can put these worries to rest. Your insurance investment will take care of your family in any situation and will help in replacing lost household income, paying for the education of your kids or even providing financial security to your family.

2. Higher savings on taxes. The premium paid on life insurance policies is eligible for the maximum tax deduction up to Rs.1.5 lakh as per Section 80C. You will also be eligible for tax-free proceeds in case of maturity/death under Section 10 (D) of the Income Tax Act of 1961.

3. Dealing with Debt

4. Helps Achieve Long-term goals

5. Life Insurance supplements your retirement goals

6. Buying Insurance is cheaper when you're younger

7. Youre business' financial requirements can also be taken care of by proper insurance policy

8. A toll for forced savings

9. You may not be eligible for it later - due to seniority, and health reasons

10. Finally, when you buy the right policy you don't buy insurance, you buy Peace of Mind for yourself

About Life Insurance Corporation of India (LIC)

- Life Insurance Corporation of India (LIC) is one of the largest life insurance providers in India that provides a wide range of insurance plans such as Term Insurance, Whole life, Endowment, and Money Bank. LIC anticipates your insurance needs and provides you with a plan that fulfils your requirements.

LIC's Insurance Plans/policies that talk to you individually and give you the most suitable options that can fit your requirement. Following are the LIC Insurance Policies:

Click Here to View Plan Document

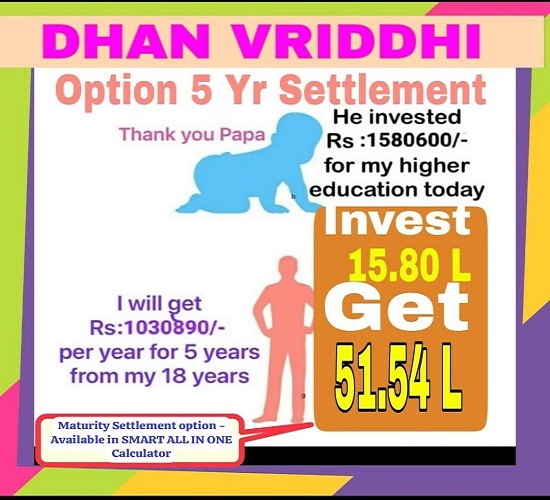

LIC Dhan Vriddhi is a single premium endowment plan. It requires a one-time premium payment.

Click Here to View Plan Document

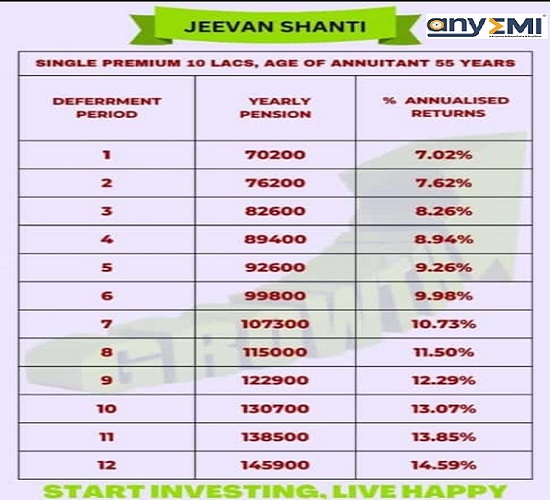

This is a single premium plan wherein the Policyholder has an option to choose an Immediate or Deferred annuity.

Click Here to View Plan Document

This is a limited premium paying non-linked endowment life insurance policy that provides both savings and protection to policyholders.The plan offers both death and maturity benefits along with profit participation bonuses.

Click Here to View Plan Document

LIC Jeevan Azad is a traditional life insurance plan that offers the combined benefits of both life protection and investments. In addition to this, the plan offers a host of other benefits such as rider benefits, tax benefits, and many more.

Click Here to View Plan Document

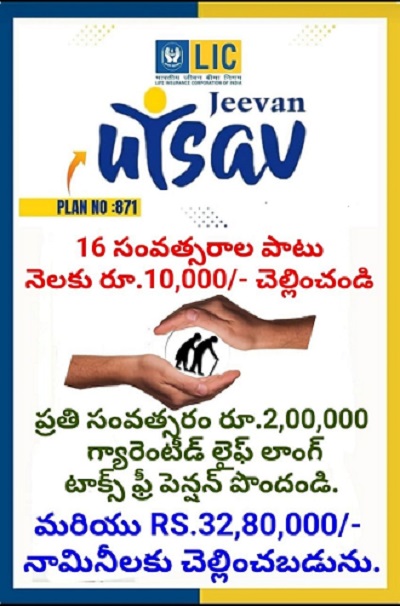

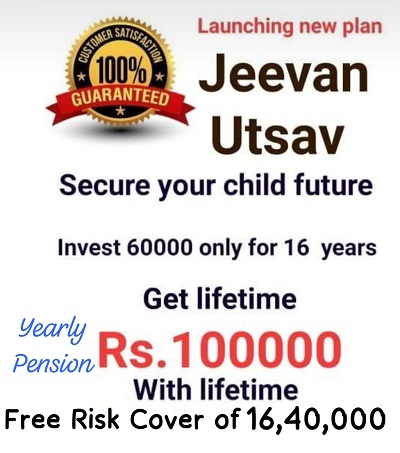

LIC’s Jeevan Utsav is a Non-Linked, Non-Participating, Individual, Savings, Whole Life Insurance plan. This plan provides financial support to family in case of unfortunate death of Life Assured and survival benefits in the form of Regular Income Benefit or Flexi Income Benefit as per the option chosen for surviving policyholder.

Click Here to View Plan Document

Click Here to View Plan Document

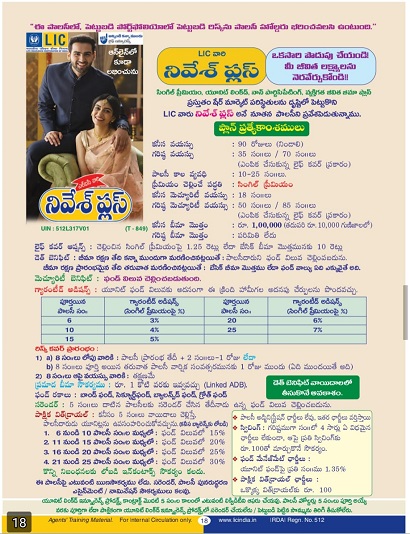

Nivesh Plus is a non-participating, unit-linked, single premium, and individual life insurance plan offered by LIC. The plan provides insurance and investment coverage throughout the policy’s duration for a single premium. This plan gives you the option of selecting the type of sum insured from the outset, as well as investing the premium in one of four different types of investment funds.

Contact us

- You can call/email us on +91 8008612200/info@anyemi.com.

Reference